At a basic level, Venture Capital (VC) funding can be described as financing provided to startups or other relatively early-stage business that are perceived to have significant growth potential. VC funding is a key to ensuring continued innovation, as companies with new ideas or technologies typically need a large amount of initial capital before profit can be realized. Most VC firms operate on a high risk / high reward model: it is expected that most companies that are funded will fail and lose money, while a small number of ventures will succeed and deliver a very high return on investment.

How does Venture Capital funding affect the Life Science Industry and why is it important?

Venture Capital funding ultimately plays a significant role in influencing the rate of new scientific advancements and products. In a typical year, the Life Sciences Industry receives billions of dollars of venture capital funding. Large drops in life science VC funding (such as the one experienced during and after the 2008-2009 recession) will negatively impact the industry’s job market as well as overall production of new innovations. Other factors can affect life science funding levels, including changes in the regulatory landscape, changes in perceived industry risk levels, and competition for VC capital from other sectors or industries.

Competition for VC capital in particular has affected life science funding in the last decade. Life science ventures often require high funding levels, and the average time to a return on an investment can be long – especially compared to the tech sector. This has led to capital moving away from traditionally strong areas such as pharma and biotech towards software and tech firms. Over time, this shift in funding will be detrimental to the Life Sciences Industry; without a continued influx of capital, the development of new life saving drugs and medical devices will inevitably decline.

What did the Venture Capital landscape look like for Life Sciences in 2014?

Startups and businesses in the Life Sciences sector have been patiently waiting to see a stable increase in VC funding since the decline in 2009. While there has been a gradual increase over the years, investors have still shown some hesitation in returning to pre-2009 levels. However, 2014 (up through Q3) proved to be a very promising year.

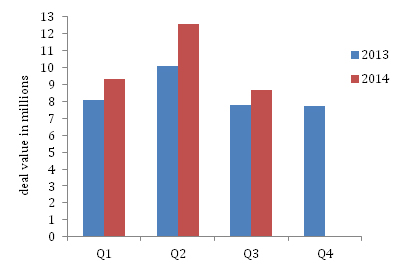

2014 had the strongest start for VC funding for Life Sciences since 2008. Quarter two of 2014 also had the highest quarterly total since the first quarter of 2001, and showed a 26% year over year and 35% quarter over quarter increase for average deal size, according to PricewaterhouseCoopers LLP.

With the massive increase in funding in the second quarter of 2014, it wasn’t shocking when the third quarter experienced a 35% quarter over quarter decrease in funding. The third quarter also showed a decline in total deal volume, but showed an increase in funding when compared to its counterpart in 2013. This is due to a 12% year over year increase in deal size. This has been the trend for every quarter in 2014 so far (see graph below).

When the final Life Science VC investment totals for 2014 are gathered, it’s likely that this will be one of the strongest years ever for funding, especially in biotechnology.

Why was 2014 one of the strongest years for VC funding of Life Sciences?

With the recent activity of venture-backed companies going public and the continued strength of the Initial Public Offering (IPO) market, it’s likely that investors affiliated with companies that have gone public will start a new cycle of investments. Startups and smaller businesses will have a chance to lobby for new potential investors.

New classes of investors have also begun entering the market, providing VC funding. According to Greg Vlahos, Life Sciences partner at PricewaterhouseCoopers LLP, there is an “emergence of new investors in the innovation economy, including the rise of hedge funds, mutual funds, and other non-traditional investors making direct investments into presumably pre-IPO companies.”

Given the funding trends in 2014, and the emergence of new investors and new classes of investors, we are optimistic that the future of Venture Capital funding for Life Sciences is bright.

References

- “MoneyTree™ Life Sciences Report, Biotech trending high.” November 2014. Web. 18 Dec. 2014.

https://pacificbiolabs.com/wp-content/uploads/2015/01/pwc-biotech-trending-high-q3-2014.pdf - “MoneyTree™ Life Sciences Report, Biotech soars to record high.” August 2014. Web. 18 Dec. 2014.

https://pacificbiolabs.com/wp-content/uploads/2015/01/pwc-biotech-money-tree-q2-2014.pdf - “MoneyTree™ Life Sciences Report, Biotech deals rising.” May 2014. Web. 18 Dec. 2014.

https://pacificbiolabs.com/wp-content/uploads/2015/01/pwc-pharma-money-tree-q1-2014.pdf - National Venture Capital Association. “VC Industry Overview.” Web. 18 Dec. 2014.

http://www.nvca.org/index.php?option=com_content&view=article&id=141&Itemid=589